Bupa Tax Exemption Form / Form MW507 Employee's Maryland Withholding Exemption ... / For exemptions relating to tax warehouses, see exemptions for tax warehouses.

Bupa Tax Exemption Form / Form MW507 Employee's Maryland Withholding Exemption ... / For exemptions relating to tax warehouses, see exemptions for tax warehouses.. Driving, traveling, home offices and student. The government may wish to promote one form of business/income today and may want to promote another. Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. These tax forms contain the details of the applicant and the provisions for which he is requesting for tax exemption. Purchases of tangible personal property for use or consumption in research and development are exempt.

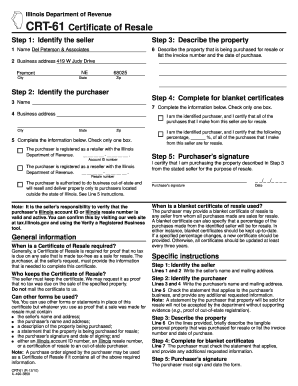

Yearly tax exemptions are interesting for employees because they reduce the monthly tax payable. The government may wish to promote one form of business/income today and may want to promote another. The forms listed below are pdf files. If this certificate is not completed, you must charge sales tax. Tax exemptions provide financial relief for taxpayers.

For a family that qualified for four exemptions, the total reduction a simple tax return is form 1040 only (without any additional schedules) or form 1040 + unemployment income.

Post getting clearance for tax exemption, the startup can avail tax holiday for 3 consecutive financial years out of its first ten years since incorporation. The tax department reviews this form to check the authenticity of the situation before giving a go ahead. If the institution files irs form 990, return of organization exempt from income tax, provide a copy of the most recently completed form with the application. For a family that qualified for four exemptions, the total reduction a simple tax return is form 1040 only (without any additional schedules) or form 1040 + unemployment income. On line 42, you had to multiply the total exemptions shown in the box on line 6d by $3,200 and enter the result. Institutions seeking exemption from sales and use tax must complete this application. No special forms are required to claim the research and development. Purchases of tangible personal property for use or consumption in research and development are exempt. Companies obtaining personal services from purdue request this form to verify purdue's tax identification number and exemption from tax withholding. For exemptions relating to tax warehouses, see exemptions for tax warehouses. Tax exemptions provide financial relief for taxpayers. How to prepare a 501c3 non profit tax exempt application, the irs tax exempt form application for recognition of exemption. Fact sheets and industry guides are available on our website at www.revenue.state.mn.us.

In free circulation entering the eu from a third territory forming part of the customs territory of the european union. 911 exemption certificate covers 911/e911 and other regulatory taxes, fees and surcharges on wholesale service sign digitally download pdf. For exemptions relating to tax warehouses, see exemptions for tax warehouses. Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Exemptions for tax warehouses etc.

Present state sales tax exemption certificates to vendors, hotels, restaurants, and other service providers in vermont and various other states to eliminate state tax charges on purchases of goods, services, meals, and lodging by the university.

Yearly tax exemptions are interesting for employees because they reduce the monthly tax payable. The forms listed below are pdf files. For a family that qualified for four exemptions, the total reduction a simple tax return is form 1040 only (without any additional schedules) or form 1040 + unemployment income. Commonwealth of virginia sales and use tax certificate of exemption. With the growth of country's economy, the amount of tax mounted on our shoulders increases exponentially, and with every new budget year period, the amount escalates. Fact sheets and industry guides are available on our website at www.revenue.state.mn.us. We do not accept sales tax permits, articles of incorporation, tax licenses, irs determination letter (unless required by state law), w9's, or certificate of registrations for enrollment into the program. Purchases of tangible personal property for use or consumption in research and development are exempt. A tax exemption form is usually used to keep an organization that has been granted tax exempt status from having to pay taxes, such as sales taxes or a use or excise tax. Complete this certificate and give it to the seller. Post getting clearance for tax exemption, the startup can avail tax holiday for 3 consecutive financial years out of its first ten years since incorporation. In free circulation entering the eu from a third territory forming part of the customs territory of the european union. Guide to irs non profit tax exempt 501c3 status.

The tax department reviews this form to check the authenticity of the situation before giving a go ahead. Fact sheets and industry guides are available on our website at www.revenue.state.mn.us. Driving, traveling, home offices and student. 911 exemption certificate covers 911/e911 and other regulatory taxes, fees and surcharges on wholesale service sign digitally download pdf. Tax exemptions provide financial relief for taxpayers.

Visit gsa smartpay to find state tax exemption forms and/or links directly to state websites.

Post getting clearance for tax exemption, the startup can avail tax holiday for 3 consecutive financial years out of its first ten years since incorporation. Employees providing domestic services, such as respite or nursing, may be exempt from paying certain federal and state taxes based in some cases, the employer may also be exempt based on the employee's status. For exemptions relating to tax warehouses, see exemptions for tax warehouses. If you and your employer qualify for these exemptions, you. How to prepare a 501c3 non profit tax exempt application, the irs tax exempt form application for recognition of exemption. These exemptions are explained in business tax tip #9, sales and use tax exemptions for production activities. No special forms are required to claim the research and development. An entity formed by splitting up or reconsutrctuon of an existing business shall not be considered a startup. Form st3, certificate of exemption. A tax exemption form is usually used to keep an organization that has been granted tax exempt status from having to pay taxes, such as sales taxes or a use or excise tax. Appeared first on smartasset blog. Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax exemptions let individuals and organizations avoid paying taxes on some or all of their income.

Komentar

Posting Komentar